Shingie Chisoro-Dube & Lauralyn Kaziboni

The world population is expected to reach ten billion by 2050, which has implications for food security in the context of climate change. In the recent $43 billion acquisition of Syngenta, a global seed company, by ChemChina, a chemicals company, the CEO of ChemChina notes that the merger was driven by China’s need to secure future food supply, given the country’s history of famines. This strategy highlights the importance of access to seeds as a key input in agricultural production. This article looks at the implications of increased consolidation in the global seed industry on access to seed and food security.

Understanding the global seed market

The global seed market is highly concentrated with a few lead international players led by Monsanto, DuPont and Syngenta (Table 1).1 In 2017, Monsanto merged with Bayer Crop Science; DuPont Pioneer merged with Dow AgroScience; and Syngenta acquired ChemChina. The main reasons driving these mergers and acquisitions include the need to secure and expand into new markets and diversify the company portfolios following the decline in prices of crops and cereals.2The approval of the above mergers will result in three corporations controlling close to 60% of the global patented seed market and 64% of the agrochemical market.

The Monsanto, DuPont and Syngenta mergers were approved subject to divesture conditions by the competition authorities in USA, Europe and South Africa. The divesture conditions are meant to remove overlaps in specific markets in an attempt to promote competition and limit any likelihood of anti-competitive conduct, which may arise from high concentration. The Dow AgroScience and DuPont merger was approved in the European Union on the condition that DuPont would divest a significant proportion of the insecticides business. The European Union also cleared ChemChina’s acquisition of Syngenta subject to ChemChina selling off products in the insecticide, herbicide and fungicide markets.

The Competition Commission of South Africa approved the Monsanto and Bayer merger with conditions. As part of the conditions, the parties were required to divest Bayer’s cotton business and avoid a monopoly in South Africa. An independent South African third party will purchase this business allowing it to autonomously supply genetically modified cotton seed in the country. Furthermore, the parties will also sell Bayer’s Liberty Link technology and Liberty-branded agro-chemicals business. Apart from these divestures, the merger removes any possibility of Bayer entering the South African market to compete with Monsanto in the development and production of seed. This follows the acquisition by Pioneer of Pannar in South Africa finalised in 2012 following a Competition Appeal Court decision to overturn the Competition Tribunal’s earlier prohibition.

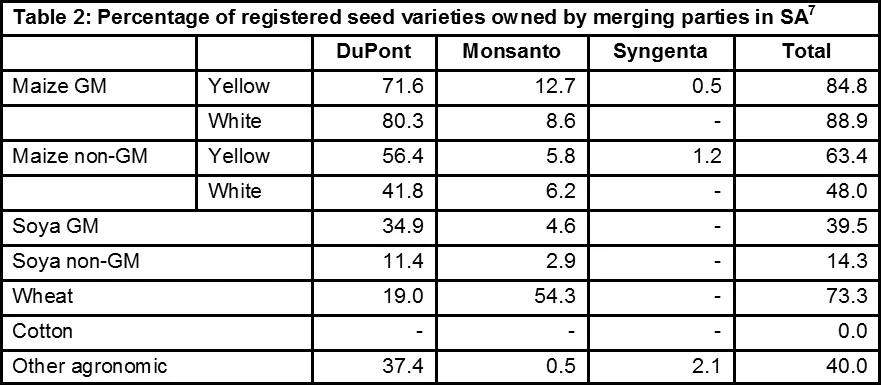

In South Africa, DuPont (Pioneer), Monsanto and Syngenta control 85% market share in the genetically modified maize seed market. Although Syngenta has limited participation in South Africa, it will have links through Adama South Africa, a manufacturer and distributor of crop protection solutions, owned by ChemChina following the approval of the merger with ChemChina.

Trends towards increased consolidation in the seed industry are also evident in other African countries. In Zimbabwe, the Competition and Tariff Commission approved the US$30 million acquisition of Pannar Seeds by Du Pont Pioneer in 2015. ZAAD Investment Limited, a South African seed manufacturing acquired 80% in local seed manufacturer, Agriseeds. In 2013, Zambian seed company, MRI Seed, was acquired by Syngenta. At the time of the acquisition, MRI Seed’s maize germplasm collection was supposedly amongst Africa’s most comprehensive and diverse.

Although mergers may lead to efficiency gains, higher concentration may result in merged entities exercising market power and raising prices, along with potential effects in terms of reducing competition in terms of innovation. This may also create a conducive environment for collusive conduct. What is apparent is that the dominance of global players in the African market and that the acquisition of local firms by global seed companies undermines local competition in the seed industry.

Innovation

Central to the agricultural sector is increased innovation in the seeds industry through investments in research and development (R&D) by lead global firms.3 Innovation through development of desired characteristics of seeds with traits such as disease and drought resistance, has led to increased agricultural productivity.

Intellectual property rights (IPRs) through the use of patents, plant variety rights, trademarks and trade secrets promote research, development and innovation. 4 Exclusive rights allow plant breeders to recoup R&D costs and earn returns from successful innovations for a specified time period, usually 20 years. This implies that competing plant breeders are prohibited from using the protected variety in the development of a new variety of seed; or reproducing and marketing the protected variety without the breeder’s licence. Upon expiration of IPRs, other seed growers are able to reproduce and market the off-patented seeds or even develop generic versions of the seed.

Although IPRs stimulate innovation and reward firms for R&D investments, global seed players may use IPRs to reinforce market power in global food value chains. 5 IPRs limit open access and traditional sharing of seeds between farmers. Farmers are prohibited from saving seeds for replanting in subsequent farming seasons or selling to other farmers. On the one hand, such contractual arrangements limit farmers’ sourcing options which increases the breeder’s revenues as the sole supplier. On the other hand, other seed growers have limited access to the patented seed, which reduces scope for cumulative innovation or development of low cost generic seeds by rival firms. As a result, farmers are subjected to high seed costs and limited seed variety.

The recent South African case involving HZPC Holland, a seed breeder and Wesgro Potatoes, a seed grower, raises important issues on the effects of exclusive rights on access to seed. HZPC developed the Mondial seed potato varietal in 1993 and was granted 20-year IPRs. The plant breeder granted Wesgro Potatoes exclusive rights to produce and sell the Mondial seed potato varietal to commercial farmers in South Africa. The breeder’s exclusive rights expired in 2013, which would have made the seed available in the open market. However, HZPC continued to enjoy the benefits of exclusive rights beyond the designated time period to the disadvantage of other potato seed growers who are unable to grow or sell the Mondial seed potato varietal.

In 2017 the Competition Commission of South Africa referred a case of alleged abuse of dominance against these firms to the Competition Tribunal of South Africa for prosecution. This illustrates that despite seed breeders being granted exclusive rights for a specific time, they can insist on exercising the exclusivity to reinforce market power and limit access of the seed to other industry players.

Implications

Agriculture is a key sector in most African economies such that access to affordable high quality seed is crucial. Disruption in seed supply may lead to a global food catastrophe. 6 Access to genetically modified seeds is thus important as it increases agricultural productivity and security of food supply. However, genetically modified seeds require the use of agrochemicals which tend to increase costs of production. Seeds constitute approximately 10-20% of overall production costs although agrochemicals and labour account for a larger proportion of production costs.

Increased input costs have implications for food security and agricultural and rural development. Small scale farmers, in particular, lack access to capital required to purchase seeds and agrochemicals and therefore continue to depend on less productive seeds saved from previous planting seasons or informal exchanges. Given that smallholder farmers constitute the majority of farmers in Africa, this may reduce total agricultural production necessary to secure food supply. Efforts to industrialise in Africa also depend on increased productivity in the agricultural sector due to its linkages with other sectors in the economy, and upgrading to higher value-added activities. There remains a key role for government to ensure appropriate enforcement of IPRs as well as the development of the local agricultural industry.

- Lianos, I., Katalevsky, D., & Ivanov, A. (2016). The global seed market, competition law and intellectual property rights: untying the Gordian knot. Research Paper Series: 2/2016, Centre for Law, Economics and Society.Moss, D. L. (2013). Competition, intellectual property rights, and transgenic seed. SDL Rev., 58, 543.

Moss, D. L. (2013). Competition, intellectual property rights, and transgenic seed. SDL Rev., 58, 543.

See note 1 & MacDonald, J. M. (2016). Concentration, Contracting, and Competition Policy in U.S. Agribusiness. Concurrences: Competition Law Review, No. 1.

- See note 1.

- See note 1.

- See note 1.

- African Centre for Biodiversity, 2017. Available here. Notably market shares in terms of sales are likely to be different as some varieties may outperform others.