By Tatenda Zengeni

The Common Market for Eastern and Southern Africa (COMESA) Competition Commission (“Commission”) opened its doors in January 2013. It is responsible for enforcing the COMESA Competition Regulations of 2004. The establishment of the regional competition authority was necessitated by the fact that national competition laws have a limited role in dealing with anti-competitive practices originating from other countries.[1] The main functions of the Commission are to: monitor and investigate anti-competitive practices of undertakings within the Common Market; mediate disputes between Member States concerning anti-competitive conduct; review regional competition policy with a view of improving the effectiveness of the Regulations; and, help Member States promote national competition laws and institutions. The ultimate objective is to harmonise national laws with regional laws in order to achieve uniformity of interpretation and application of competition law and policy within the Common Market.[2]

In order to achieve these objectives, the COMESA Competition Regulation provides for the establishment of two separate autonomous bodies, namely the Commission and a Board of Commissioners. The COMESA Competition Commission is responsible for investigating any activities that restrain competition in the region. The Board of Commissioners is the adjudicative body that makes arbitrations and rulings on competition cases and hears appeals. This institutional setting is driven by the need for transparency and fairness in addressing competition issues. Within its first year of operation up to December 2013 the Commission had received eleven merger cases, of which ten have been approved, and is yet to receive any case on restrictive business practices.[3]

Benefits of a regional competition authority

The establishment of regional competition authorities such as COMESA has advantages to the member states which are part of the regional grouping. Regional competition authorities reduce resource constraints faced by national competition authorities, by pooling together resources that enable the regional body to reach economies of scale in the enforcement of competition law.[4] Moreover regional competition authorities provide a platform where member states can pool together financial resources that can be used for investigations and undertaking competition advocacy programmes which can be difficult if conducted by individual countries. In the same vein a regional competition body becomes very important for those member states that do not have competition laws in place. Regional authorities can also assist in the detection and prosecution of anti-competitive conduct that transcends borders.

Five COMESA members do not have competition law in place (Table 1), namely, Democratic Republic of Congo, Djibouti, Eritrea, Libya and Uganda. The establishment of the Commission will benefit these countries by allowing the 19 Member States to pool resources towards competition enforcement and greater regional integration.

Furthermore, regional competition authorities help to reduce public choice limitations; that is, political pressures from interest groups.[5] In developing countries political power is at times concentrated in a few individuals who can negatively influence the enforcement of national competition laws. This form of interference is altered by regional bodies and will reduce the pressures that come from these powerful political groups.

Analysis and developments under COMESA

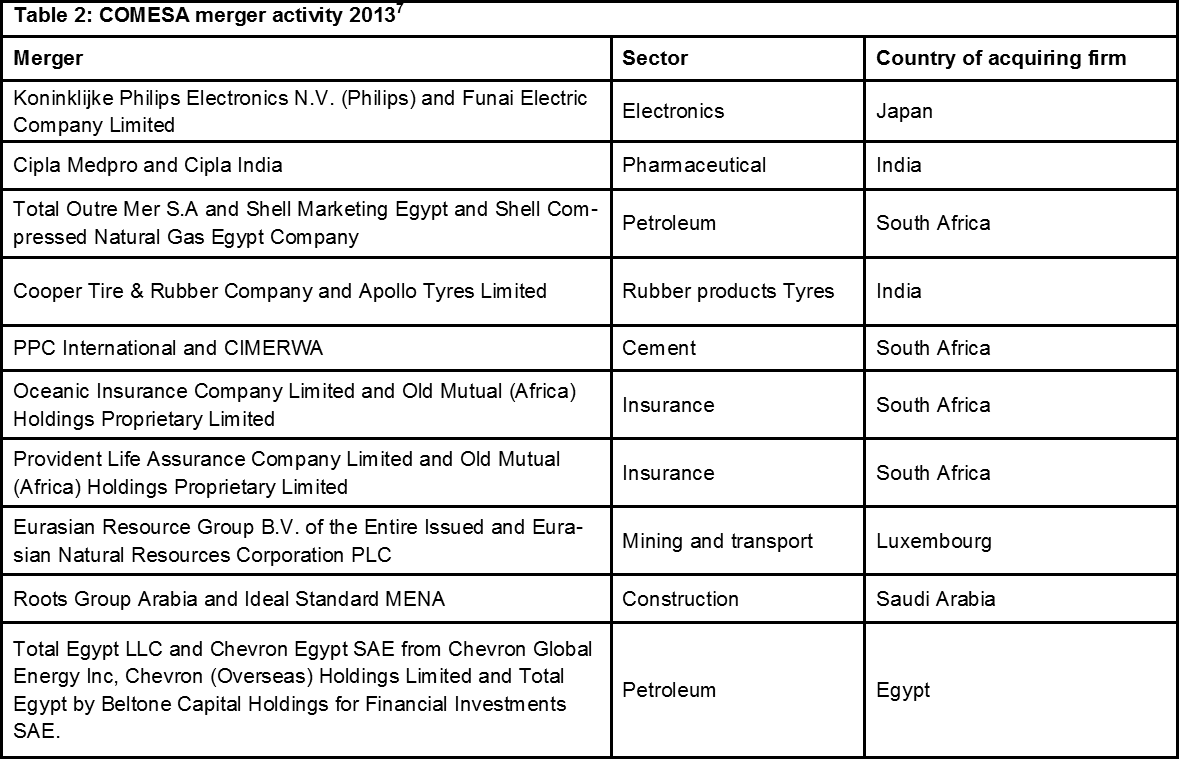

In 2013, the Commission assessed ten merger cases which were each approved without conditions (Table 2).[6]

Nine out of the ten mergers involved firms from non-COMESA countries acquiring firms operating in COMESA. The only exception is the Total Egypt merger which involved firms from COMESA countries. The petroleum and insurance sectors recorded two mergers each and were related to the same companies.[7]

The investigation of these merger cases has brought to the fore the challenges around the interpretation and application of the law. One such issue relates to the area of jurisdiction of the regional body. The issue arises from the fact that COMESA competition law regulations supersede the jurisdiction of national competition authorities, for example on transactions that involve two or more Member States. This has created friction between the COMESA Commission and national competition authorities. The Kenya Competition Authority has publicly expressed its view that merging parties must continue to notify mergers locally regardless of whether the transaction has been notified with the COMESA Commission.[8] This situation creates uncertainty for investors as they are not sure of the proper notification procedure and this can even prove to be costly if they are compelled to notify with both regulators since failure to notify will result in high penalties.

The other challenge relates to the fact that there is no merger threshold within the COMESA regulation.[9] All companies seeking to acquire businesses operating in COMESA are required to pay notification fees. The implication is that small business which could benefit from merging could end up failing to pay the notification fees. The second issue concerns the high notification fees. The rules explicitly set the filing fees at 0.5% of the parties’ combined turnover or assets in the COMESA region with a cap of COM$500 000 (which is equivalent to US$500 000). This significantly increases the costs for companies that seek to acquire companies operating in COMESA.

Despite the challenges that have been faced to date, it is premature to critically assess the progress made by the Commission. Moreover, COMESA has shown the willingness to correct and improve on some of the anomalies related to enforcement of its competition law. For instance, in August 2013 the Commission called for proposals for consultancy services on revising competition law so as to meet international best practices. The project was expected to start at the end of October 2013, some of the deliverables of which include the need to revise the zero notification thresholds and the time periods for the evaluation of transactions.

Notes

1. Cronje, J. B. ‘COMESA Competition Commission merger approval regime’ (4 September 2013). Trade Law Centre website.

2. COMESA Competition Commission website.

3. Global Competition Review (2014). ‘The African and Middle Eastern Antitrust Review 2014’.

4. Fox, E. M. (2012). ‘Competition, Development and Regional Integration: In Search of a Competition Law Fit for Developing Countries’ in Law & Economics Research Paper Series Working Paper No. 11-04.

5. See note 4.

6. Four additional merger notices have been issued in 2014: Acquisition of Supaswift by FedEx Corporation, AFGRI Limited by AgriGroupe Holdings, Adcock Ingram Holdings by CFR Inversiones SPA, and OFD Holdings Inc. by Yara International ASA.

7. See note 2.

8. Mumo, M. ‘Authority criticises Comesa arm over rollout of competition rules’ (17 March 2013).

9. See note 1.