Anthea Paelo

There are important linkages between firm behaviour, competition and trade and agricultural policy. This discussion reviews the main insights from the African Competition Forum studies on the regional cement and sugar industries, pointing out cross-cutting issues in these industries and their effect on competition and regional trade.

Cement industry

The cement industry across the region is highly concentrated and largely oligopolistic with many of the firms conducting operations and holding controlling interests across different countries and even among smaller fringe independent suppliers. The ACF study assessed competition issues in Botswana, Kenya, Namibia, South Africa, and Tanzania.1 Looking at the country level, in three of the countries one producer (or group of associated producers) accounts for more than 50% of production capacity. In Zambia and Kenya companies associated with Lafarge have accounted for the majority of capacity. In Namibia recent entrant Ohorongo is effectively the only local producer. In South Africa and Tanzania three to four producers have accounted for 80% of production, while Botswana is largely served by imports from South Africa in addition to small local producers.

A comparison of estimated ex-factory prices reveals that Zambia’s prices have been the highest throughout the period assessed (of 2000 to 2012) while South African prices have been the lowest apart from at the height of the cartel in 2005 when Tanzania prices were slightly lower (Figure 1). Kenya prices have generally been the next highest, until recent years when the divestiture of Lafarge’s associated company from Athi River Mining and the entry of two smaller producers (National Cement and Mombasa Cement) increased competition somewhat. Tanzania prices, on the other hand, have remained substantially lower than those in Kenya, apparently reflecting greater local competitive rivalry and an openness to imports which meant it saw nominal reductions in local currency cement prices after 2007 (not observed in either Zambia or Kenya). Botswana and Namibia prices, on their part, have tracked above South African prices, although the entry of Ohorongo in Namibia led to a sharp reduction in prices relative to the other countries and are close to the post-cartel prices in South Africa.

These outcomes were largely influenced by a cement cartel which covered the southern African Customs Union (SACU) until 2009 involving the four producers (PPC, Lafarge, Afrisam and NPC) who agreed on market shares in the region and shared monthly sales information. A comparison of the post-cartel ex-factory prices in the period 2010-2012 shows that prices in most of the countries remain above those in South Africa (Table 1).

Competition in the cement industry is severely undermined by the fact that the same firms are present in different neighbouring countries, especially where those firms have a history of collusive behaviour between them. In the context of smaller domestic markets, it is of course likely that we see more concentrated markets and so the nearest competitor may in fact be located across the border and can be a source of competitive rivalry. However, if firms have allocated territories in the region to one another effectively creating territorial monopolies, barriers to entry are heightened and competition and trade is distorted.

Competition in the cement industry has been severely under- mined by the fact that the same firms are present in different neighbouring countries, especially where those firms have a history of collusive behaviour between them. In the context of smaller domestic markets, it is of course likely that we see more concentrated markets and so the nearest competitor may in fact be located across the border and can be a source of competitive rivalry. However, if firms have allocated territories in the region to one another effectively creating territorial monopolies, barriers to entry are heightened and competition and trade is distorted.

SUGAR INDUSTRY

Kenya, Namibia, South Africa and Zambia have substantial sugar industries where domestic and trade regulation have resulted in outcomes which are inconsistent with the structure of markets. Kenya and Tanzania for example are net importers and have historically protected their industries from imports, although Tanzania has been more progressive in lifting these restrictions.1 Zambia and South Africa are low cost net exporters. Zambia is also the most productive and most efficient producer, with 106 tons of cane produced per hectare compared to the 40 to 60 tons of cane per hectare in the other study countries. Similarly, Zambian producers use 8.1 tons of cane to produce a ton of sugar (in 2011) compared to 8.35 in South Africa, 9.93 in Tanzania and 10.74 in Kenya.

What is most interesting is the market structure in each country. In Zambia, Zambia Sugar (Illovo, now Associated British Foods) has made massive investments in milling infrastructure since the mid 2000s and now has a market share in excess of 90%. The scale of production in Zambia is approximately double what is needed for domestic consumption which suggests that Zambia Sugar’s investments were also geared towards export markets. However, Zambia’s exports within the region are still mostly into DRC, with the remainder of production going towards markets outside of Africa.

Kenya, on the other hand, has a large number of producers, but the four largest still account for 78% of production. None of these firms are major multinationals (although some ownership is by foreign interests) and imports are heavily controlled. The emphasis on increasing domestic entry to this market as part of agricultural policy has not been matched by investments into increasing effective competition and supporting the production of sugar cane. In Tanzania, two companies account for 70% of production (with the largest, Kilombero, being 75% owned by Illovo, and the second company TPC being majority owned by Sukari of Mauritius that also has interests in Kenya). In South Africa, three companies (Illovo, TSB and Tongaat Hulett) account for over 80% market share.

Another key characteristic of the sugar industry is the role of the state. The industries in Kenya and Tanzania in particular have had a substantial role played by the state. In Kenya extensive state ownership appears to have been associated with poor performance and a painful adjustment process, as new private entrants compete with state-owned and privatized mills. Overall there is a shortage of cane resulting in excess milling capacity while imports in Kenya are required to meet the domestic shortfall. However, imports from outside COMESA through the COMESA safeguards are constrained by high levels of protectionism and sluggish production in member states. Furthermore, what is most concerning is the limited imports from stronger producers such as those in South Africa and Zambia. Appropriate agriculture and industry policy is therefore important to grow production and improve efficiencies in countries such as Kenya and Tanzania.

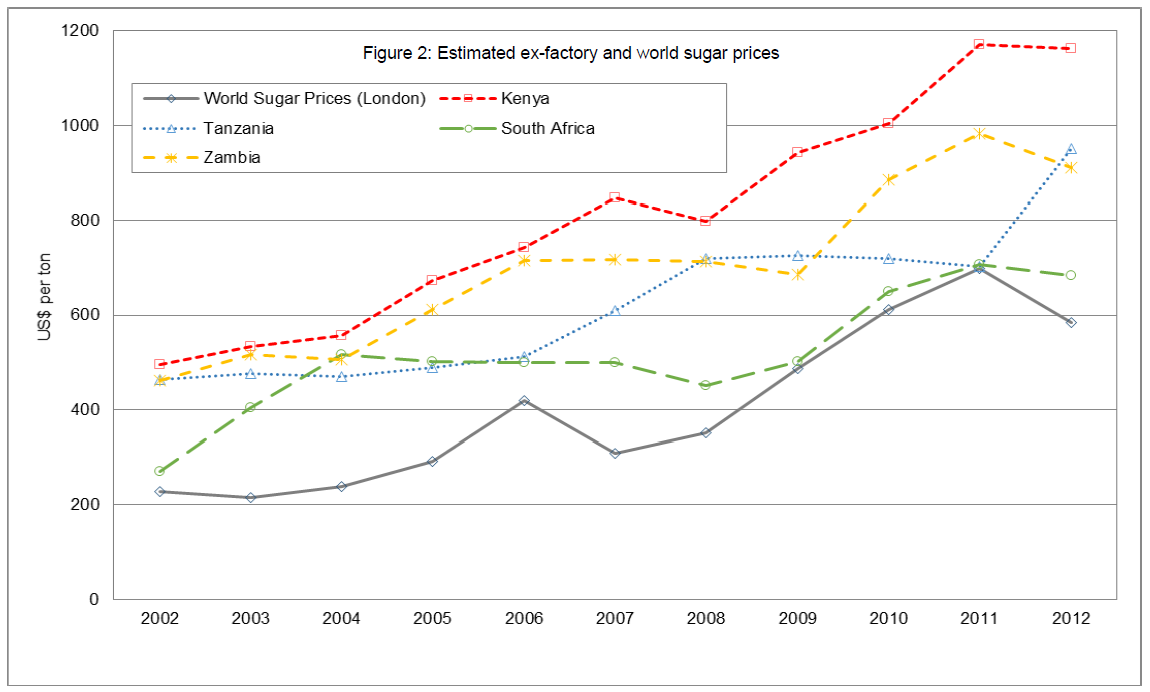

Sugar prices also vary considerably across countries (Figure 2). As net importers, Kenya and Tanzania’s prices should be heavily influenced by the openness to imports. Instead, Kenya has recorded much higher prices than Tanzania reflecting choices made around protecting the local industry.

Despite being a low cost producer and substantial net exporter, prices in Zambia are among the highest while prices in South Africa have been lowest of all the four countries (estimated on an ex-factory basis) (Figure 2). Zambian prices have been close to 50% higher than South African prices for much of the period 2002 to 2012, on an ex-factory basis and not accounting for additional costs such as marketing which may affect this difference. Although relatively lower than the comparators, South African prices are sustained by local market regulation which ensures that world prices do not depress the local price. This suggests that South African domestic prices could be lowered.

Exports from Zambia are largely to the EU and to countries in the region without significant sugar industries such as DRC, meaning that consumers in other countries in the region are not benefiting from greater import competition on the basis of lower costs of production in Zambia. While Zambian producers may have a preference for exports into Europe, given the very large transport costs these exports are likely to yield prices to the producer which are not much better than sales to the local market. At the same time, the Zambian market is effectively protected against imports through non-tariff barriers as well. This ensures that sugar prices in Zambia remain high despite the production efficiencies.

The competition concerns within and across countries are linked to the particular choices about regulations and trade barriers. This is not to argue for wholesale liberalization, indeed it is a regulatory regime in South Africa which has yielded substantially lower prices than in other countries. It is therefore not clear that the exercise of unilateral market pow- er in Zambia would be addressed by liberalization.

CONCLUSION

A discussion of the two industries has shown that there are certain cross-cutting issues. The low levels of effective competition have substantial negative impacts for countries’ economies, increasing the costs of investment and infrastructure and raising prices to consumers. Cross-country comparisons suggest prices in some countries are as much as 50% in some years above levels in more competitive markets, without obvious differences in production costs. Trade barriers also tend to reinforce the market power of large firms in individual countries. In order to achieve more competitive outcomes, complementary policies (including industrial and agricultural policies) are required to support entrants in national economies, lower production costs and improve efficiencies, operating alongside effective competition enforcement at national and regional level.

NOTES

1. Mbongwe, T., Nyagol, B.O., Amunkete, T., Humavindu, M., Khumalo, J., Nguruse, G. & Chokwe, E. (2014). Understanding competition at the regional level: An assessment of competitive dynamics in the cement industry across Botswana, Kenya, Namibia, South Africa, Tanzania and Zambia. African Competition Forum

2. Chisanga, B., Gathiaka, J., Nguruse, G., Onyancha, S. & Vilakazi, T. (2014). Competition in the regional sugar sector: the case of Kenya, South Africa, Tanzania and Zambia. African Competition Forum