Jason Bell and Teboho Bosiu

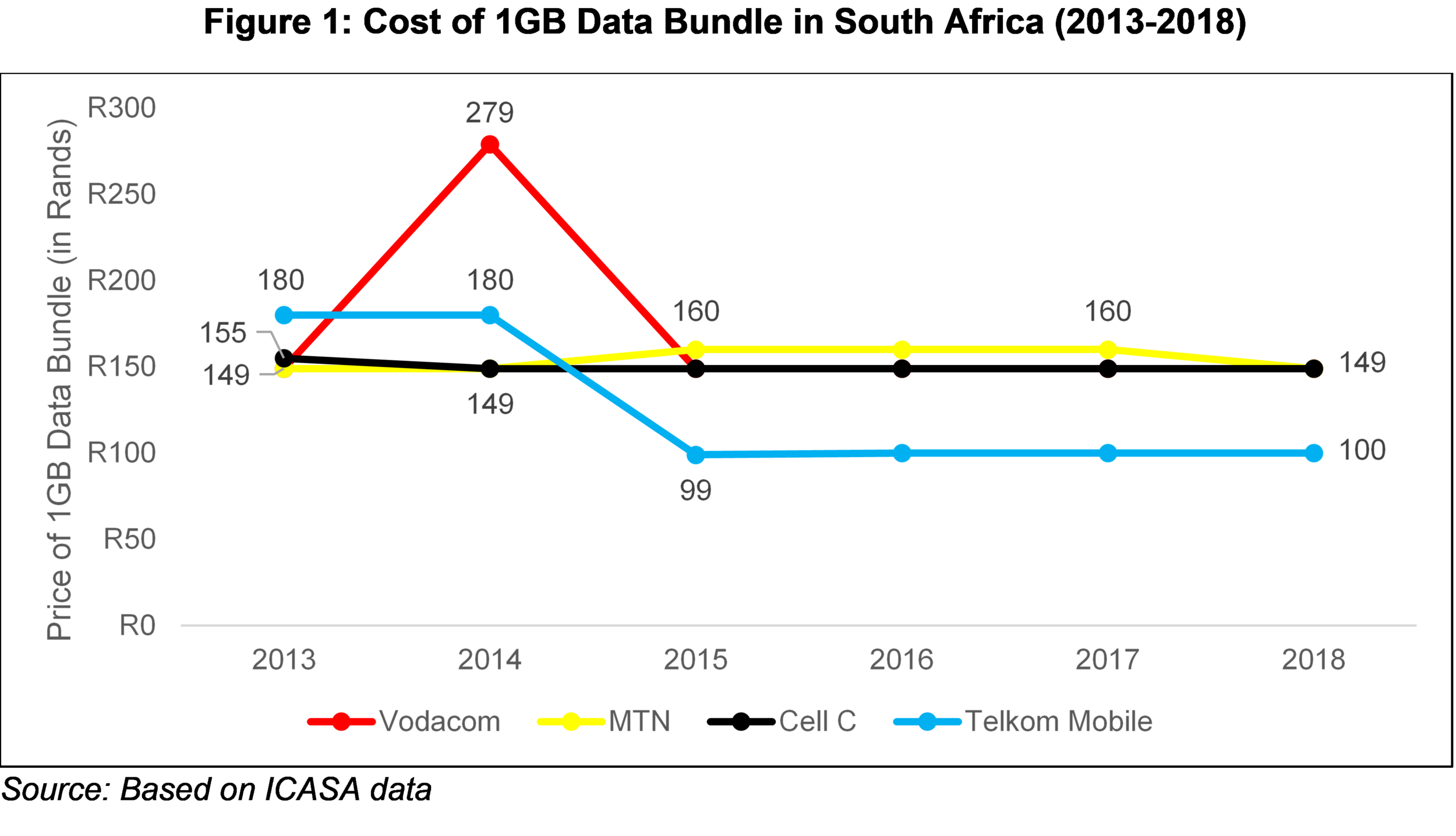

There have been widespread calls for data costs in South Africa to be reduced in recent years. In 2018, the entry of a new competitor, Rain, shows how increased competition in South Africa’s telecommunications industry can reduce data costs and increase innovation. Since 2013, the price of a 1GB data bundle has not fallen below R149 (with the exception of Telkom Mobile). Rather, data prices have remained stagnant at this level for Vodacom and Cell C over the past three years, or slightly above R149 in the case of MTN (Figure 1). Given the additional pressures of high unemployment, low wage growth, and persistently high levels of inequality, South Africa’s high cost of data only serves to add to the already high cost of living for the majority of South Africans. Moreover lower income consumers currently pay a larger proportion of their income on data costs.

South Africa has the potential to provide a much wider population access to internet services through reduced prices of data. In 2015, South Africa was projected to experience significant growth (CAGR of 67%) in mobile data traffic over the next 5 years. With further projections that 62% of mobile devices will be ‘smart’ by 2019, there are opportunities to improve living standards of the majority of South Africans. Responding to this potential for growth requires substantial investment in network capacity through, amongst others, establishment of new companies. This article reflects on the main barriers to entry in the mobile telecommunications industry, through key insights from the entry of Rain.

Rain is a Stellenbosch-based mobile data operator, backed by prominent businessmen Patrice Motsepe, Paul Harris and Michael Jordaan. The company (which is 40 per cent black-owned) has to date managed to penetrate a tightly held telecommunications industry, through a unique and competitive offering. Rain offers data only instead of traditional voice services, thereby significantly reducing the price for consumers to connect to the internet. This is because Rain’s spectrum is not shared between data and voice services. Spectrum is finite, and therefore its utilization has implications on output and price. Customers can use other platforms such as WhatsApp, Facebook Messenger and Skype to make voice calls to other users of these platforms, or they can continue using other operators’ networks for voice services. Rain charges R50 per gigabyte of data for an unlimited period of time, which is half the cheapest rates of competing service providers (Figure 1).

Barriers to entry – the key issue behind high data costs in South Africa?

The telecommunications industry has inherent characteristics mean structural barriers to entry are high, such as network effects, high costs of infrastructure and significant scale economies. The implication is that the telecommunications industry is concentrated, and that it is especially difficult for entrants or smaller firms to reach scale. Thus, incumbent firms have extensive market power, which can be leveraged to undermine smaller rivals and entry. For instance, mobile network operators can make the switching process from one operator to another difficult and inconvenient (for consumers) even while number portability has been enforced. This locks-in consumers with incumbents and makes it difficult for entrants to attract a sufficient number of consumers to compete effectively.

While effective regulation is critical for opening up the market to smaller rivals, strategic conduct by entrenched incumbents means that they can also act to block entry and stifle rivalry. The South African telecoms industry has a higher C3 concentration ratio (97%) than Nigeria (84%) and Ghana (82%). Vodacom and MTN account for 75% of the 89 million SIM connections. Until the entry of Rain, the only four major mobile communications companies were Vodacom, MTN, Cell C and Telkom Mobile. However, Rain is still very small in terms of subscribers relative to these companies.

At issue is not necessarily the fact that the industry is concentrated, but whether there is significant competitive rivalry between the main operators. Although Nigeria and Ghana’s telecoms markets are also concentrated, there is significant rivalry amongst the players which has seen to significant reduction in prices of services as players innovate and adopt the latest technologies. In South Africa, this has not necessarily been the case between the key players.

The other significant barrier to entry is spectrum limitations. Insufficient radio frequency spectrum prevents small service providers from entering the market. Radio frequency spectrum refers to wireless frequency network used as a transmission medium for electronic communications and broadcasting. Reallocation of spectrum is largely determined by government regulation, and limited access to additional spectrum compels mobile operators to spend on costly physical network infrastructure. This is expensive, especially for new and smaller entrants, given the absence of effective facilities leasing regulations. The poor enforcement of the facilities regulations, such as leasing and national roaming, delays the progress of services competition which points to the significant scope for regulatory changes to support spectrum sharing, trading and pooling, as these interventions can lead to the efficient use of spectrum and lower barriers to entry.

Assessing the entry of Rain

Rain entered the South African telecoms sector based on a view that the mobile broadband industry is undersupplied. The company’s primary objectives were to establish a cutting-edge LTE-A fixed and mobile network, designed to meet growing consumer demand; to provide simple and transparent access to data; and working towards open access to the internet at affordable rates and best quality. This is important and different in that data does not ‘expire’ (which is now enforced across operators through recent regulatory changes which came into effect in 2019), and users can track and manage usage and cost overtime.

Rain managed to bypass some of the major entry barriers in two main ways; 1) leveraging existing spectrum assets; and 2) entering into a facility sharing agreement with an established incumbent.

Leveraging existing spectrum assets

Rain was established following the rebranding of an existing wireless telecoms company – Wireless Business Solutions (WBS) – in 2017. WBS was a holding company of iBurst and Broadlink, players in the wireless segment of the telecommunications industry. The company was acquired by Multisource in 2015, a company backed by both Paul Harris and Michael Jordaan. Subsequently, a decision was taken to rebrand WBS into Rain, largely because iBurst technologies had become obsolete, and the “Wireless Business Solutions” name was too long.

The rebranding process included iBurst’s adoption of a new super-fast Long Term Evolution-Advanced (LTE-A) technology in 2017. LTE technology is primarily used for data communications, and is typically implemented over higher radio frequency spectrums. Prior to the acquisition by Multisource, and later rebranding into Rain, WBS/iBurst already had access to spectrum in the 1800Ghz and 2600Ghz frequencies. Thus, not only did Rain have access to spectrum, it had access to valuable spectrum compatible with the latest technologies such as the LTE. None of the other mobile operators, except Telkom, have access to higher frequency spectrum. This gives Rain a competitive advantage in the LTE data market.

On the other hand, lower frequencies are more attractive to the voice communications markets because the lower the frequency, the longer the radio waves and the less they are inclined to bounce off solid objects. That means a larger area can be covered with a single transmitter, resulting in significant drop in the cost of building a communication network. All the other mobile operators (with the exception of Rain) have access to this band of spectrum. This explains why Rain decided not to compete in the voice segment of the telecommunications market. Moreover, Rain believes the market for mobile data is on the rise. Industry research points to the declining voice revenues and increased use of IP-based services such as instant messaging in Africa as evidence of this demand shift.

Facilities sharing agreement

In terms of infrastructure sharing, Rain has an agreement with Vodacom, which allows it to put its broadcaster equipment on Vodacom’s towers. In exchange, Rain allows Vodacom subscribers to roam on its network, giving them better coverage and less congestion. The arrangement (which was apparently approved by the competition authorities, although no official confirmation has been accessible) ensured that Rain could have access to important infrastructure whilst building its own. By 2018, Rain had rolled out more than 2500 of its own LTE-A towers, with plans to increase this figure to 5000 over the next two years.

Conclusion

A lack of rivalry in the telecommunications industry has meant exorbitant prices of data in South Africa. Limited spectrum and costly infrastructure are structural and regulatory barriers in the industry. To overcome some of the main barriers, Rain leveraged existing spectrum assets. Further, the company entered into a facilities sharing agreement with Vodacom to leverage Vodacom’s established infrastructure whilst in the process of building its own.

The fact that it had access to these resources and its ability to enter into a facilities sharing agreement does not necessarily mean that the experience of Rain is replicable by other potential entrants. It certainly does not imply that barriers are not high in the industry. Instead, the unique conditions under which the company entered further highlight the challenges of entry as these conditions are unlikely to be replicated by others looking to invest in the industry.

Furthermore, the fact that Rain is not able to compete in the voice market due to unavailability of suitable lower frequency spectrum means there is limited competitive rivalry in this market. Similarly, other operators are not able to effectively compete in the provision of high-speed data services that are compatible with advanced technologies such as 4G or 5G, due to inability to access suitable high frequency spectrum. In the end consumers’ mobile services choices are limited by both competition and regulatory constraints, which no doubt contributes to high prices. The positive impact of a new rival in this market despite these constraints, points to the need for regulations that favour entrants and stimulate rivalry between the incumbent operators across the various services.