Industrial Development Think Tank: Policy Brief 16[1]

Lorenza Monaco[2], Jason F Bell and Julius Nyamwena[3]

Introduction

If South Africa aims to build technologically competitive niches and deepen the automotive supply chain, a suggested option is to explore the potential for technological upgrading and localisation in plastic auto components. In this regard, looking at the path followed by Thailand can certainly provide interesting lessons.

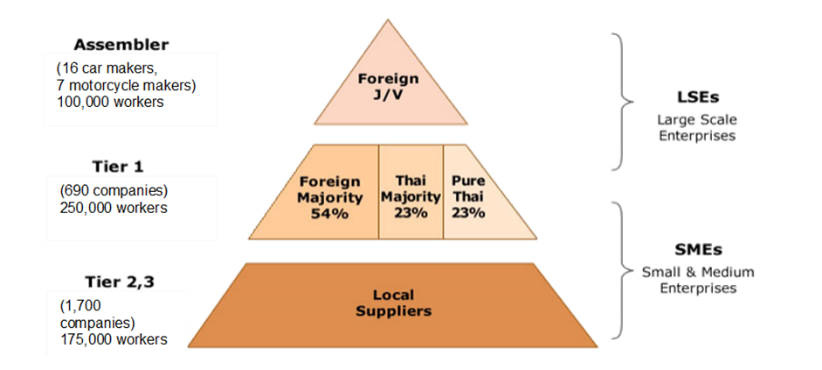

Today, Thailand can count more than 2000 automotive component manufacturers (typically SMMEs) with roughly 700 of these being Tier 1. Tier 2 and 3 are also well-developed compared to South Africa. Over the past 20 years, the Thai automotive chain has been the target of numerous government policies aimed at building competitive clusters and attracting FDI. The OEMs present in Thai have also played an important role in building infrastructure, training personnel and transferring technological capabilities to domestic firms. Together with the auto industry, the plastic sector has also experienced significant expansion, being one of the fastest growing export industries, largely based on the export of high value-added products.[4]

Figure 1: Automotive Supply Chain in Thailand

Source: TAPMA (2014)

Technological capability and supply chain development: key enablers

In terms of technological capability, Thailand managed to build a competitive advantage that now places the country way ahead compared to South Africa in the transition to the fourth industrial revolution. Through a comparative study utilizing existing literature and interviews with business associations and plastic auto component firms in both SA (Gauteng) and Thailand (Bangkok industrial area), the IDTT identified five key enablers that can explain Thailand’s relative success. These include: a well-designed policy framework; the presence of industrial clusters; a more favourable relationship between State and foreign capital; better institutional coordination and the access to a proper regional market.

On the auto policy side, Thailand became a leading production hub thanks to a well-designed Masterplan, which also informed the SA policy framework. This combined a series of tax (exemption or reduction of import duties on machinery and raw materials, and corporate income tax exemptions and reductions) and non-tax incentives (permission to bring in foreign experts, own land, and take or remit foreign currency abroad; up to 100% ownership allowance for foreign business), with a number of conditionalities. For instance, in the case of the Eco Car, OEM investments are required to meet two criteria in order to qualify: first, a minimum demonstrated volume output of 100,000 units, and secondly, the processing of certain engine parts must be undertaken locally (ASCCI, 2016).

Ultimately, the Thai auto masterplan has guaranteed a good balance between support and control over foreign investment, securing production volumes and the development of a local value chain. The plastic sector has also benefitted of significant government support, both in terms of encouraging the production of high-tech, light plastic composites, and in direction of meaningful eco-innovation.[5]

With regard to its spatial development, the Thai industry has combined progressive integration into global value chains (GVCs) with the benefits of clustering, added to the presence of functioning special economic zones and of a strong regional market. Overall, the efforts made by the Thai government to promote industrial clusters helped to attract FDI and facilitate technology transfers.[6] Indeed, the clustering effect was crucial in sustaining the dramatic expansion of the local supply base.

Figure 2: Location and number of automotive components manufacturers in Thailand, 1996 & 2006

Source: Warr & Kopaiboon (2017)

Currently, Thailand is trying to combine the benefits of clustering with the advantages of a large SEZ, within its Eastern Economic Corridor project.[7] This establishes the idea of Super-Clusters, designed with a focus on positioning Thailand as a major player in future industry through research and development, high technology industry, and low-labour intensive manufacturing. In addition to the cluster dimension, the competitiveness of the Thai industry was also built through the country’s strong presence within the ASEAN Free Trade Area (AFTA). The existence of an established regional market defined significant intra-ASEAN trade flows, and boosted the demand for Thai exports, especially from the Philippines, Indonesia and Malaysia.[8]

Thailand’s competitiveness was also built through a better state – business bargaining relationship and through stronger institutional coordination. With regard to the former, the Thai state managed to create favourable conditions to attract FDIs, but also to set requirements in terms of localisation and domestic supplier development. Overall, the role of Japanese capital was crucial in facilitating know-how and technological learning. For example, Toyota keeps providing considerable training and assistance to its local suppliers.[9]

Finally, Institutional coordination was observed not only in the way the Thai state centralised and channelled the developmental activity of Central Economic Agencies and of the technocratic layers of the government, but also in the way it promoted a common strategic vision for the industry. This is evident in relation to the different clustering initiatives, but also with regard to the promotion of a widespread debate on the fourth industrial revolution.

Deriving lessons for South Africa

South Africa’s structural weaknesses have been highlighted in the IDTT’s previous study. Here, the investigation of the factors that enabled Thailand’s success in building technological competitiveness and deepening the automotive supply chain sheds further light on the direction South Africa should possibly follow. Firstly, it is clear how the vertical integration within GVCs is not sufficient to build a strong, domestic supply base. Without the combination of local development policies like the promotion of industrial clusters and well-functioning SEZs, vertical integration has a limited impact. In addition, assisting in the establishment of a regional market is also of vital importance.

Thus, the Thai experience shows how a more balanced approach in the provision of support to foreign OEMs – to be attached to more stringent conditions, and better institutional coordination in the development of a common strategic vision are key ingredients for success. Ultimately, localisation and supply chain deepening interventions will not be effective in the South African auto industry without an in-depth consideration of all these factors.

This policy brief is part of a series developed for the Industrial Development Think Tank (IDTT).

You can find more information about the IDTT here.

You can download this policy brief here.

For more information regarding this brief contact the author (lmonaco@uj.ac.za)

[1] The Industrial Development Think Tank at UJ is housed in the Centre for Competition, Regulation and Economic Development, in conjunction with the SARChi Chair in Industrial Development, and supported by the DTI which is gratefully acknowledged. This paper reflects the views of the authors alone and not of the DTI or any other party.

[2] Institute for Economic Development and Planning (IDEP), School of Economics, UJ, lmonaco@uj.ac.za

[3] Centre for Competition, Regulation and Economic Development (CCRED), UJ, jasonb@uj.ac.za; juliusn@uj.ac.za.

[4] Kraipornsak, P. (2014). The Plastic Industry of Thailand.

[5] Interviews with Plastic Institute of Thailand and UNIDO Sub-regional Office in Bangkok, October 2018.

[6] Techakanont, K. & Charoenporn, P. (2011). Evolution of Automotive Clusters and Interactive Learning in Thailand. Science, Technology & Society, 16(2), pp. 147-176.

[7] From interviews with TAPMA and UNIDO, Bangkok, October 2018. See also See PRWEB, 2017 “Government of Thailand Announces New 4.0 Investment Attraction Policies”, online at https://www.prweb.com/releases/2017/02/prweb14092747.htm.

[8] Nag, B., Banerjee, S. & Chatterjee, R. (2007). Changing Features of the Automobile Industry in Asia: Comparison of Production, Trade and Market Structure in Selected Countries. Asia-Pacific Research and Training Network on Trade Working Paper Series, No. 37.

[9] Interview with BFK, Bangkok, October 2018.