In the past year, various countries in SADC have considered amendments to their competition laws. Botswana, South Africa, Tanzania and Zimbabwe have amended or are proposing amendments to their competition laws in order to make the legislations more applicable to their economic and social contexts. These developments are consistent with a shift in developing countries from transplanting aspects of their competition laws from international frameworks, to a focus on using competition policy as a tool for addressing particular challenges within their local economies.

Regulating piped-gas: Sasol’s pricing and the impact on large industrial users

The Supreme Court of Appeal (SCA) in May 2018 made a decision to have the National Energy Regulator of South Africa’s (NERSA) methodology for regulating piped-gas prices reviewed. The natural gas market has seen rapid expansion over recent years, growing as an alternative source of energy in South Africa and the southern African region. Gas is a key source of energy for both industrial and residential use. In the market for piped-gas, Sasol is the dominant supplier and importer of piped gas transmitted from Mozambique.

Rain brings hope in the mobile telecoms sector

There have been widespread calls for data costs in South Africa to be reduced in recent years. In 2018, the entry of a new competitor, Rain, shows how increased competition in South Africa’s telecommunications industry can reduce data costs and increase innovation. Since 2013, the price of a 1GB data bundle has not fallen below R149 (with the exception of Telkom Mobile).

Digital banks: game-changers in South Africa’s banking industry?

In 2017, the South African Reserve Bank issued three new banking licences to Discovery, Bank Zero and TymeDigital. These are the first licences issued to new banks in more than a decade since the issuing of a bank licence to Finbond Mutual bank in 2001. In the State of the Nation address in 2018, the South African president hailed this as an opportunity to ensure competitive rivalry in a highly concentrated sector. However, the potential for entrants to bring disruptive competition with substantial benefits to consumers needs to be assessed in the context of challenges in the banking industry in South Africa.

Merger Control Provisions: The case of Creeping Acquisitions

Part of the focus of the proposed amendments to the Competition Act is on preventing creeping concentration. Creeping concentration results from a series of mergers and acquisitions that individually do not raise market power substantially, but do so collectively. Firms can increase market share through mergers and acquisitions, and consequently increase market power and concentration in markets.

Conglomerate and vertical effects of acquisition-led growth: The case of retail giant, Steinhoff

The recent collapse of Steinhoff International Holdings (“Steinhoff”), a global retail giant, raises concerns around the interest and strategies of large corporates. Steinhoff has sparked controversy over “accounting irregularities”, which cost the retail giant R282 billion in stock market value.

Developments in Mobile Money in East Africa

The provision of mobile money services has been a dynamic and fast-growing sector in Africa. Beyond money transfer, the industry in different countries has evolved to provide additional services such as bill and merchant payments as well as financial services such as credit, insurance and savings. In East Africa, Tanzania, Uganda and Kenya have at least one mobile money provider offering a savings and credit facility.

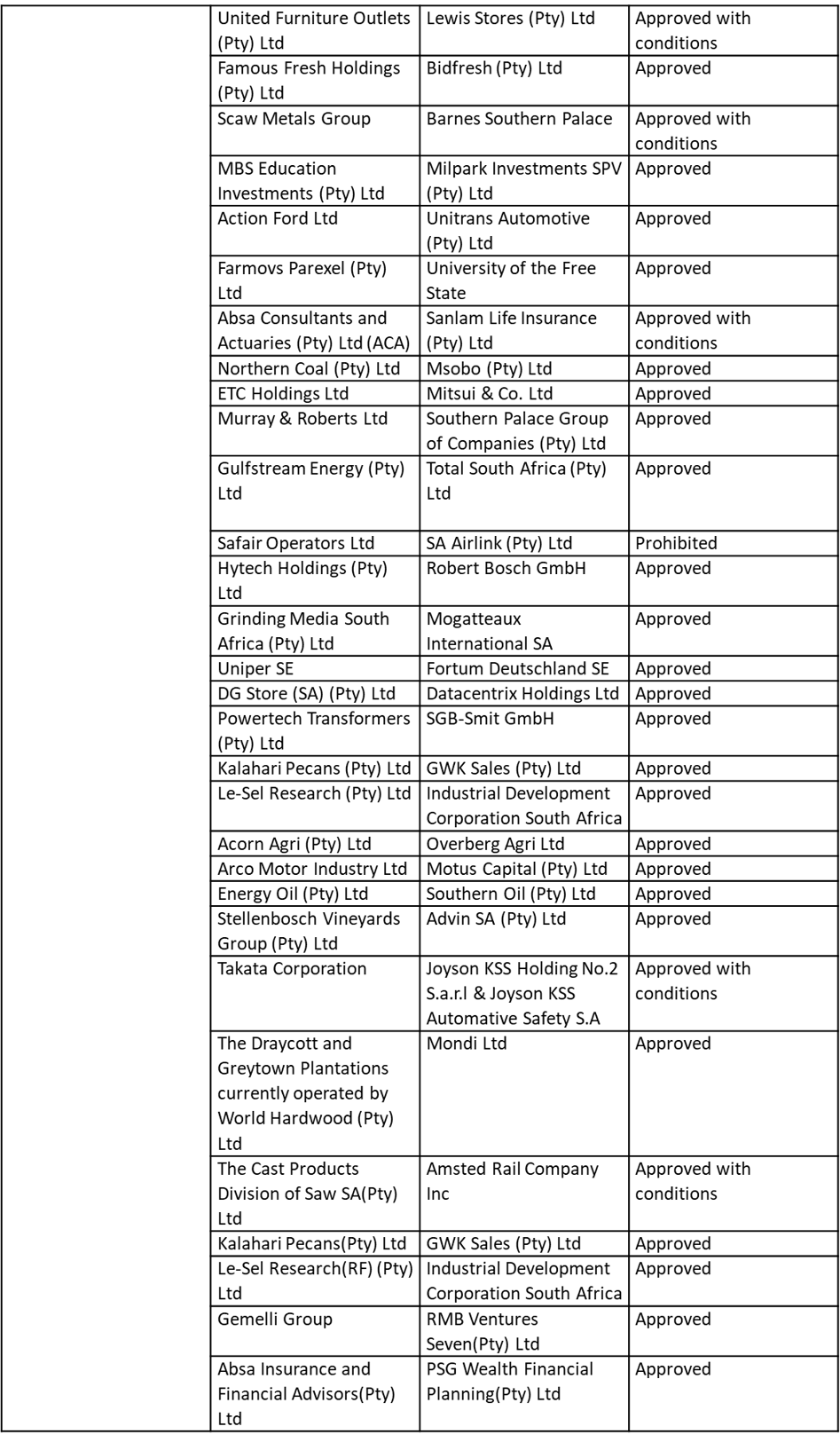

Quarterly Competition Case Update - May 2018

EXCESSIVE PRICING IN THE GLOBAL PHARMACEUTICAL INDUSTRY

In the developing world, disease and poverty are interdependent making access to essential medicines at affordable prices even more critical. 80% of the two billion people worldwide without access to essential medicines live in low income countries. As such, competitive rivalry in the pharmaceutical industry can improve access to medicines by reducing prices and through motivating brand companies to challenge existing patent drugs and create new and improved medicines. Furthermore, upon expiration of patent drugs, competition encourages generic companies to provide less expensive alternatives of medicines.

THE IMPORTANCE OF ACCESS CONDITIONS IN VERTICAL MERGERS: VEHICLE ASSEMBLY IN KENYA

On 29 August 2017, the Competition Authority of Kenya (CAK) approved with conditions the proposed acquisition of Associated Vehicle Assemblers Limited (AVA) by Simba Corporation Limited (Simba Corp). The approved merger sees the acquisition of an additional 50% of the shares in AVA which were previously controlled by Marshalls East Africa Limited (Marshalls).

HEINEKEN DEVELOPING A TASTE FOR LOCAL CRAFT BREWERS

One of the world’s largest brewing houses, Heineken, has taken a step towards a larger share of the South African beer market with the acquisition of the local black owned craft brewer, Soweto Gold, in October 2017. This development comes just months after Heineken bought out the Stellenbosch-based brewery, Stellenbrau. The mergers mean that the brands can now be marketed to a global customer base. While this may be good for the respective owners of the acquired firms, the transactions reflect the challenges faced by Soweto Gold and other small brewers in accessing routes to market on their own.

CARTELS INVESTIGATED IN SOUTH AFRICA: POSSIBLE IMPACT IN THE REGION?

Most countries in Southern Africa are net importers of products from South Africa and are therefore likely to be subject to South African cartels. Imports from South Africa cut across sectors including food, capital equipment, construction materials, energy, plastics and chemical products. Moreover regional markets are closely linked through the presence of South African companies in the rest of the region. This article expands on an earlier article in this Review on the possible impacts of some of the South African cartels on the region, as part of CCRED’s monitoring of competition case developments and the evolution of enforcement in the region.

EXCLUSIONARY ABUSE IN THE ROOIBOS LIMITED CASE

The local rooibos market in South Africa comprises 8 large processing firms which account for approximately 90% of the market, with Rooibos Limited controlling 60% of the market. Similar to other processing firms, Rooibos Limited purchases large quantities of tea from commercial farmers and processes it into bulk tea which is subsequently sold to packaging firms to pack into finished products. A case against Rooibos Limited has recently been referred to the Competition Tribunal alleging exclusionary abuse of dominance in contravention of section 8(d)(i) of the Competition Act.

QUARTERLY COMPETITION CASE UPDATE - DECEMBER 2017

The Case for Patient Capital: Small Business Funding in South Africa

Small and Medium Enterprises (SMEs) are key drivers of inclusive growth in the South African economy, contributing about 55% to the gross domestic product, while their contribution towards employment is as high as 60%. In addition, small firms and new entrants enhance competition within different economic sectors, resulting in lower prices and greater variety for consumers, as well as dynamic and productive efficiencies.

Recent Cartel Penalised in South Africa: Possible Impacts in the Region?

The South African Competition Commission has been very successful in uncovering cartels, with a large number of settlements over the past 10 years. It should be noted that settlements typically involve an admission on the part of the companies involved. Given the regional scope of many companies’ activities across southern Africa this begs the question as to whether these cartels affected neighbouring countries and should also be prosecuted in these countries.

South Africa's Public Transport Market Inquiry: Integrating Modes

The Competition Commission of South Africa’s land-based public passenger transport market inquiry, which commenced in June 2017, addresses a range of questions including issues with intermodal transport links. The inquiry relates to excessive short distance passenger transport fares charged by buses, peak season long distance bus fares, operational subsidies disadvantaging operators that are not subsidised, and restricting particular providers to operate in specific areas and routes. The issues to be considered cut across several public transport modes. The inquiry coincides with the Gauteng provincial government’s plan to expand its high speed train, Gautrain, into two of Gauteng’s largest townships.

Key Issues in Developing Cosmetics, Soaps, and Detergents Value Chains - South Africa and Zambia

Firm competitiveness can be understood as the ability to provide products and services at least as efficiently and effectively as competitors. At the industry level, international competitiveness is the ability of domestic firms to achieve sustained success against foreign competitors such as in terms of unit labour costs and relative productivity. Competitiveness is critical if a country’s firms are to take advantage of the opportunities presented by the regional and international economy. Furthermore, it can stimulate industrialisation and economic growth which subsequently promotes job creation, higher productivity and innovation.

What can we Learn from the First COMESA Restrictive Business Practice Case?

The Implications of Global Consolidation in the Seed Industry

The world population is expected to reach ten billion by 2050, which has implications for food security in the context of climate change. In the recent $43 billion acquisition of Syngenta, a global seed company, by ChemChina, a chemicals company, the CEO of ChemChina notes that the merger was driven by China’s need to secure future food supply, given the country’s history of famines. This strategy highlights the importance of access to seeds as a key input in agricultural production. This article looks at the implications of increased consolidation in the global seed industry on access to seed and food security.